Revenue Sharing and Conflicts of Interest

- Josh Itzoe

- Oct 17, 2021

- 7 min read

A major focus of excessive fee litigation has been the argument that fiduciary breaches have arisen for imprudent share class selection and improper usage of revenue sharing. I’d like to discuss some of the challenges and complexities associated with both.

Revenue Sharing and Share Classes

Every mutual fund has fees deducted at the fund level before returns are calculated. These fees are known as expense ratios and cover the costs to manage the investment option (i.e., investment management, operations, and legal expenses). A portion of the expense ratio can include revenue sharing, which may offset some or all of the plan’s administrative expenses. Recordkeepers, TPAs, and advisors/brokers may receive revenue sharing payments from some or all mutual funds in a plan to help pay for each respective service provided to the plan. This is called indirect compensation because it comes from the funds instead of directly from the plan or participant accounts.

Many mutual funds have various share classes that are identically managed but have different fee structures associated with them, including different amounts of revenue sharing, which go by names such as 12b-1, sub-transfer agency, or administrative services fees. Think of share classes as different trim levels of the same make and model of a car. For instance, I own a Ram 1500 pickup truck, which comes in six different versions, ranging from the least expensive (the Tradesman) to the most expensive (the Limited). When buying a vehicle, the highest trim level has the most features and luxury items and costs the most. You pay more, but you get more. With mutual funds, it’s the inverse - the more you pay, the less you get because those fees reduce your net returns. When buying a mutual fund, you want to purchase the least expensive share class because that will deliver the highest net return. Here’s an example of the six different retirement share classes for the American Funds Growth Fund of America, including the expense ratio and revenue sharing amounts:

*Returns provided by Morningstar.

There are some important things to note. First, the total expense ratio equals the sum of the management fee, 12b-1 fee, Sub-TA fee, and other fees. Second, the management fee goes to American Funds as compensation for managing the fund, and the amount (0.27 percent) is uniform across every share class. Third, the “Other Fees” are uniform at 0.04 percent, except for the R-2 share class, which is slightly higher, though the math works out to the same as the R-1. Last, using the 2019 return of each share class, you can see the difference in returns is roughly the difference in total expense ratio. So what’s the main difference between the share classes? It comes down to the amount of revenue sharing. Consider that 12b-1 fees are paid to brokers/advisors, while Sub-TA fees are paid to recordkeepers and TPAs, although sometimes both types of fees can be collected by the same service provider.

Conflicts of Interest and Fee Inequality

Share classes and revenue sharing can create many issues within a plan. First, since revenue sharing is embedded in the expense ratio of the fund, there is a natural lack of transparency. This can create confusion, mistrust, and the feeling that fees are hidden or haven’t been fully disclosed. With the plan sponsor disclosures, this is a perception-versus-reality issue, like the example I used of the CFO who had the disclosure notice but didn’t understand it. It’s a different story, however, with participant disclosures. Here, the regulation doesn’t require the actual amounts of revenue sharing to be itemized and disclosed. Rather, the participant disclosure needs only include language to the effect of “some expenses of the plan have been paid by revenue from the investment funds.”

Second, the amount of revenue sharing can spiral out of control as the plan grows if plan fiduciaries aren’t vigilant about monitoring share classes. For instance, let’s say a plan has $1 million in it and negotiates a fee of $10,000 for a broker. The plan uses a share class that pays the broker a 12b-1 fee of 1 percent or $10,000 ($10,000÷ $1,000,000). Three years down the road, the plan has grown to$3 million through a combination of plan contributions, market returns, and employee growth. If the plan is still using the same share class, the broker is now receiving $30,000 in 12b-1 fees (1 percent × $3 million) or three times the amount as when they were hired. Assuming they are not providing an expanded scope of services that warrants this amount of compensation, it could be deemed excessive and imprudent. While this situation occurs a lot less than it used to, you would be surprised at how often this still happens in the real world, especially with smaller plans that don’t have a strong governance process in place.

Third, the potential for conflicts of interest is high when there is revenue sharing. It’s been common within plans to have some funds that revenue share and some funds that don’t, which is known as “uneven” compensation. I’ll illustrate my point with a simple example of a plan that has only one participant with a $100,000 account balance and only two funds in it: Fund A and Fund B. Both are large cap growth funds, except Fund A has a total expense ratio of 1 percent and a 12b-1 fee of 0.50 percent. Fund B has a total expense ratio of 0.10 percent and no 12b-1 fee. Let’s assume that the non-fiduciary broker is sitting down with this participant to discuss their investments. You can seethe conflict of interest and the misalignment of incentives. If the broker recommends Fund A, she will make $500 (0.50 percent× $100,000) and the participant’s total portfolio expense will be$1,000 (1 percent × $100,000). But if she recommends Fund B, with no 12b-1 fee, she will earn nothing, and the participant’s total portfolio expense will be $100 (0.10 percent × $100,000). Which fund is she more likely to recommend?

Another issue that uneven revenue sharing payments create is the lack of equitability or fairness for participants. That’s because anyone who invests in funds that revenue share will under write the administrative cost for those who invest in funds that don’t. This is called fee inequality.

Let’s use an example of a plan with three funds (Funds A, B, and C). Fund A pays revenue sharing of 0.50 percent, Fund B pays revenue sharing of 0.25 percent, and Fund C pays no revenue sharing. Let’s also assume there are three participants in the plan(Participants A, B, and C). Participants A and B both have an account balance of $100,000, and Participant C has an account balance of $50,000. Here’s how the math works:

As you can see, Participants A and B pay different administrative amounts based on the investments they choose, even though they have the same account balance. Participant C pays nothing toward the administrative cost of the plan. This creates both fee inequality and potential conflicts of interest.

Let me share four methods to solve these issues.

Option #1 - Use The Same Share Class

The first method for eliminating fee inequality and conflicts of interest is to use the same share class so every fund in the plan pays the same amount in revenue sharing and also eliminates the conflict of interest. This is easier said than done. Not every fund company uses the same share class naming convention (e.g., R-3), and when they do, the amounts of revenue sharing often vary. Here’s an example where all three funds pay revenue sharing of 0.50 percent, which is applied on a pro rata basis:

Outcomes:

Creates fee fairness and equitability.

Lacks transparency and is difficult to communicate to participants.

Requires the use of higher-cost share classes.

Can be challenging to implement across multiple fund families.

Option #2 - Credit Revenue Sharing Back To Participants And Charge A Pro Rata Or Per Capita Fee

The second method is to credit revenue sharing payments back to participants and to assess each participant a direct pro rata (%) or per capita ($) administrative fee. This also eliminates fee inequality and potential conflicts of interest. Once again, Fund A pays revenue sharing of 0.50 percent, Fund B pays revenue sharing of 0.25 percent, and Fund C pays no revenue sharing. But with this method, the revenue sharing in Fund A and Fund B is credited back to Participant A and Participant B, and all three participants are assessed a direct pro rata fee of 0.25 percent.

Outcomes:

Creates fee fairness and equitability.

Makes fees more transparent.

Can be harder to communicate to participants.

Has additional disclosure requirements.

Provides flexibility in allocation methods (per capita or pro rata).

Option #3: Adjust Revenue Sharing By Investment On A Participant-By-Participant Basis

The third method is to create a fee adjustment (either positive or negative) for each investment based on the amount of revenue sharing payments. Again, this not only eliminates the potential conflicts of interest and fee inequality but also lacks transparency and can be hard to communicate. Here’s an example where a plan wishes to levelize administrative fees so that every participant pays 0.25 percent through revenue sharing. Like the prior example, Fund A pays revenue sharing of 0.50 percent, Fund B pays revenue sharing of 0.25 percent, and Fund C pays no revenue sharing. Each fund would receive a positive (i.e., increase) or negative (i.e., decrease) adjustment to its revenue sharing so that every participant pays 0.25 percent.

Outcomes:

Creates fee fairness and equitability.

Lacks transparency and can be hard to communicate to participants.

Has additional disclosure requirements.

No ability to charge per capita fees.

Option #4: Use Zero Revenue Sharing Funds

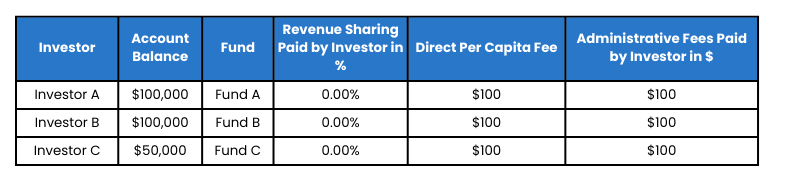

The fourth method is to use zero-revenue sharing funds and assess each participant a direct pro rata (%) or per capita ($) administrative fee. This is the simplest approach because all participants pay the same amount, and it eliminates fee inequality and potential conflicts of interest. It’s similar to option 2, but it allows a plan to move to the lowest-cost share class for which the plan is eligible, which is a major argument of excessive fee cases. Here’s an example where none of the funds pay revenue sharing, and all three participants are charged a per capita fee of $100:

Outcomes:

Creates fee fairness and equitability.

Makes fees transparent.

Easy to communicate to participants.

Provides access to lowest-cost share classes for which the plan is eligible.

Provides flexibility in allocation methods (per capita or pro rata).

Comments